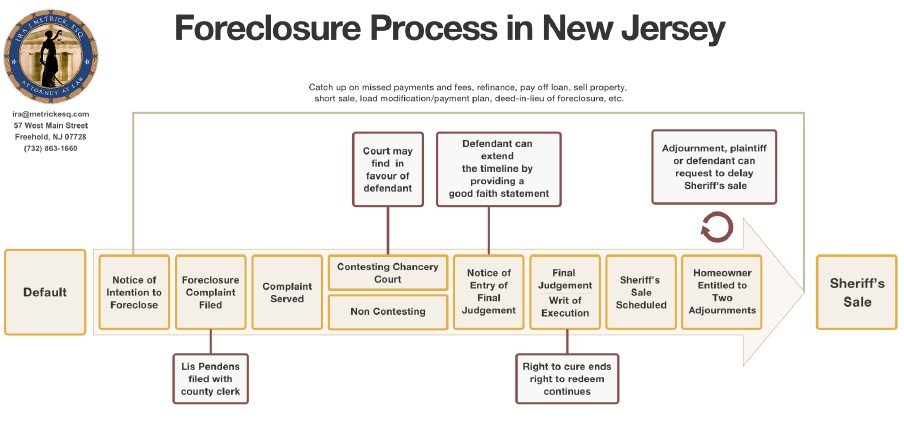

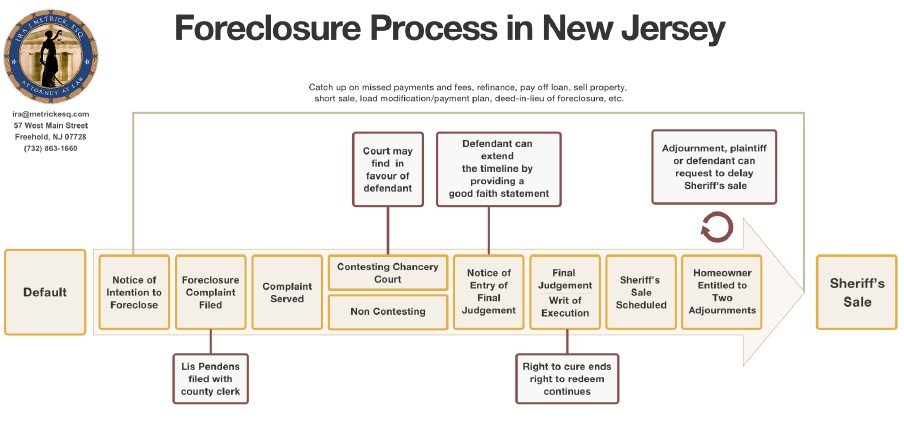

If you are facing foreclosure in New Jersey, it is critical that you understand the steps in the process. Keeping track of deadlines and answering your mail in a timely manner can be the difference between staying in your home or not. Below is a timeline of the major steps in a New Jersey foreclosure.

Although every foreclosure case is different, below are the general steps in the timeline of foreclosure in New Jersey:

The homeowner defaults on their mortgage payments. The lender or servicing company can begin the foreclosure process once there are past due payments.

The homeowner receives a Notice of Intent to Foreclose from their lender or servicer, giving them a final chance to reinstate their mortgage and get back on track with payments before the lender files the Foreclosure Complaint.

The public Foreclosure Complaint is filed, and Lis Pendens is filed with the county clerk.

The homeowner is personally served with the complaint. If service fails for whatever reason, the lender will serve the complaint by mail or by publishing in a local newspaper.

The homeowner may file an answer to the complaint in Chancery Court – contesting or non-contesting. To properly defend themselves, they must file a contesting answer to the foreclosure complaint within 35 days of being served the complaint. A contesting Answer is one that disputes the Lender’s right to foreclose. If the homeowner files a contesting answer, the Court will issue a scheduling Order to allow for Discovery and possibly a Trial.

If the Homeowner can prove the Plaintiff does not have the right to foreclose, the Complaint can be dismissed. It is increasingly difficult to get Complaints dismissed. If a Complaint is dismissed, it is normally, “without prejudice.” This means that the lender can fix whatever mistakes were made and file a new Complaint. If a Complaint is dismissed “with prejudice” it means that the lender cannot file a new complaint and the property cannot be foreclosed. This is very rare. If the case can be dismissed, it should be evaluated to see if there are any claims that can be brought against the Lender or the Attorneys for improper actions.

If the Lender can show that they have the right to foreclose through a Motion to Strike the Answer, Motion for Summary Judgment, or at a trial, the litigation is over and the Lender can move towards a Sheriff Sale. The homeowner then receives a Notice of a Right to Cure, which gives one more chance to reinstate the loan and avoid foreclosure. At this point, the homeowner can extend the timeline by providing a good faith statement which says that they have a reasonable probability of obtaining the funds needed to reinstate the loan.

If the funds are not paid to reinstate, the Homeowner will receive a Notice of Motion for Entry of Final Judgment, which means the lender is asking the court to set the exact amount owed so they can schedule a Sheriff Sale. At this point, the homeowner can object to the amount due by showing proof that the Lender’s figures are wrong.

The lender obtains Final Judgment and Writ of Execution. The lender is no longer required to let the homeowner reinstate the mortgage. However, in many cases they will still allow reinstatement. But the homeowner still has options.

The Sheriff Sale is scheduled. The amount of time between the lender applying for a sheriff sale and the date of the sale can vary depending on how busy the County’s schedule is.

The homeowner is entitled to two Adjournments of up to 30 days to delay the sale.

The Sheriff Sale takes place. This is the final stage in the foreclosure process. Once the sheriff sale is complete, the new owner will need to obtain a Writ of Possession or Order for Ejectment, in order to make the homeowner leave the property. They cannot simply lock them out of the house.

Foreclosure defense can be simple. Many people are not looking to fight. They understand that they missed payments and would rather use their resources to try to fix the situation. They may have experienced financial hardships and just need time to make a plan. They seek an attorney to represent them to confirm that the lender that is trying to foreclose has the proper proofs. They also want an attorney to be available throughout the process to answer questions and explain each step, without extensive legal fees and litigation. For these homeowners, I offer a fixed fee to Answer the Foreclosure Complaint and conduct discovery to determine if the lender has the proof that will be accepted by the Court. If we believe that the lender will prevail in Court, we settle the case to get as much time as possible, and I stay on the case to receive and explain all notices, so that my clients understand what will happen and how much time they have. If we find a defect in the lender’s case, we discuss whether it makes sense to invest in a fight.

Foreclosure defense can also be complex. There are situations where the lender does not have the right to foreclose and it is necessary to fight in Court. These types of cases include, but are not limited to, situations where the homeowner was making payments under a loan modification, or the lender does not have a recorded Assignment of Mortgage. I generally avoid Predatory Lending claims. In cases where litigation is necessary, a homeowner needs to be prepared for significant legal fees based upon hourly billing. Time must be spent to prepare specific defenses and Counterclaims in response to the Complaint. If a claim is not described properly, it is at risk of being dismissed. Depending upon the defense, depositions could be required. After that, there will likely be a Motion by the lender to Strike the Answer or to obtain Summary Judgment. To defend the motion and file a cross Motion to Dismiss the Complaint requires several hours of attorney time. If the lender’s motion can be defeated, the next step is a Trial where the lender must produce a witness to testify as to why the lender has the right to foreclose. Trials take several hours of preparation and can last for more than one day. I offer representation for these types of cases, when the homeowner understands the costs and risks and I believe I can succeed in Court based upon the claims.

In all of my cases, I am trying to find defects and get the Foreclosure Complaint dismissed. If we can get the foreclosure complaint dismissed, I evaluate the case to see if there are claims that could be brought in Federal Court. In many cases where we can get the complaint dismissed, I offer to represent the homeowner to file a Federal Complaint under the Fair Debt Collections Practices Act (FDCPA). I am also reviewing my cases to see if there are any claims related to the loan, which may be brought against the Lender or their Attorneys, under:

When there is an issue or concern about RESPA or TILA or the NJCFA, or the case is complex, we have a valuable resource for our clients. Dann Law is a multi-state law firm that has a focus on RESPA and TILA. Many of our clients have been represented by Dann Law in Federal Actions against the lender or their attorneys, and I have Co-Counselled cases with them. Javier Merino, Esq. is the Partner of Dann Law responsible for NJ. You can view their information and some of our successes here.

No matter what stage of the foreclosure process you are in, there may still be a chance to save your home. The sooner you reach out to an experienced NJ foreclosure defense attorney, the more options you will have. Contact us today for a free consultation.